The Swiss Financial Market Supervisory Authority (FINMA) and the UK’s Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) have formalized a memorandum of understanding (MoU) to strengthen regulatory coordination and facilitate cross-border financial services under the Berne Financial Services Agreement (BFSA). The BFSA, signed by Switzerland and the UK on 21 December 2023, establishes a framework for mutual recognition in selected financial sectors, including insurance and investment services, and will take effect at the beginning of 2026.

The MoU details practical measures for implementing the BFSA, providing clarity on notification procedures, annual return submissions, registration requirements, and supervisory engagement. Authorities will maintain ongoing dialogue and reserve the right to intervene when necessary in the other jurisdiction to ensure regulatory compliance and market integrity.

Information exchange is a central component of the agreement. FINMA, FCA, and PRA will share supervisory insights either upon request or proactively, strengthening oversight mechanisms and risk management for cross-border activities. This coordinated approach is expected to enhance transparency and bolster confidence among investors and clients participating in the respective markets.

For institutional and professional investors, the agreement may broaden access to Swiss and UK financial products, including retail investment services such as contracts for difference (CFDs), while remaining subject to the regulatory oversight defined in the MoU. The framework sets clear expectations for operational compliance, risk reporting, and investor protections, helping market participants navigate cross-border activities with reduced legal uncertainty.

The agreement builds on a history of cooperation between Swiss and UK regulators, formalizing protocols that reflect best practices in supervision and compliance. Market participants can expect that once the BFSA comes into force, processes for notifications, record-keeping, and reporting will be streamlined, enabling more efficient engagement in cross-border investment and insurance services.

Separately, the FCA has launched a consultation seeking feedback on the applicability of its existing rules to crypto-focused firms. The review considers governance, operational resilience, financial crime prevention, and consumer protection, and may lead to formal FCA authorization requirements for regulated digital asset activities once HM Treasury introduces enabling legislation.

The MoU signals a strategic step toward harmonizing Swiss and UK financial markets, supporting cross-border investment and insurance services, and establishing robust mechanisms for supervisory cooperation and market integrity ahead of the BFSA’s implementation.

You can read the full MoU below…

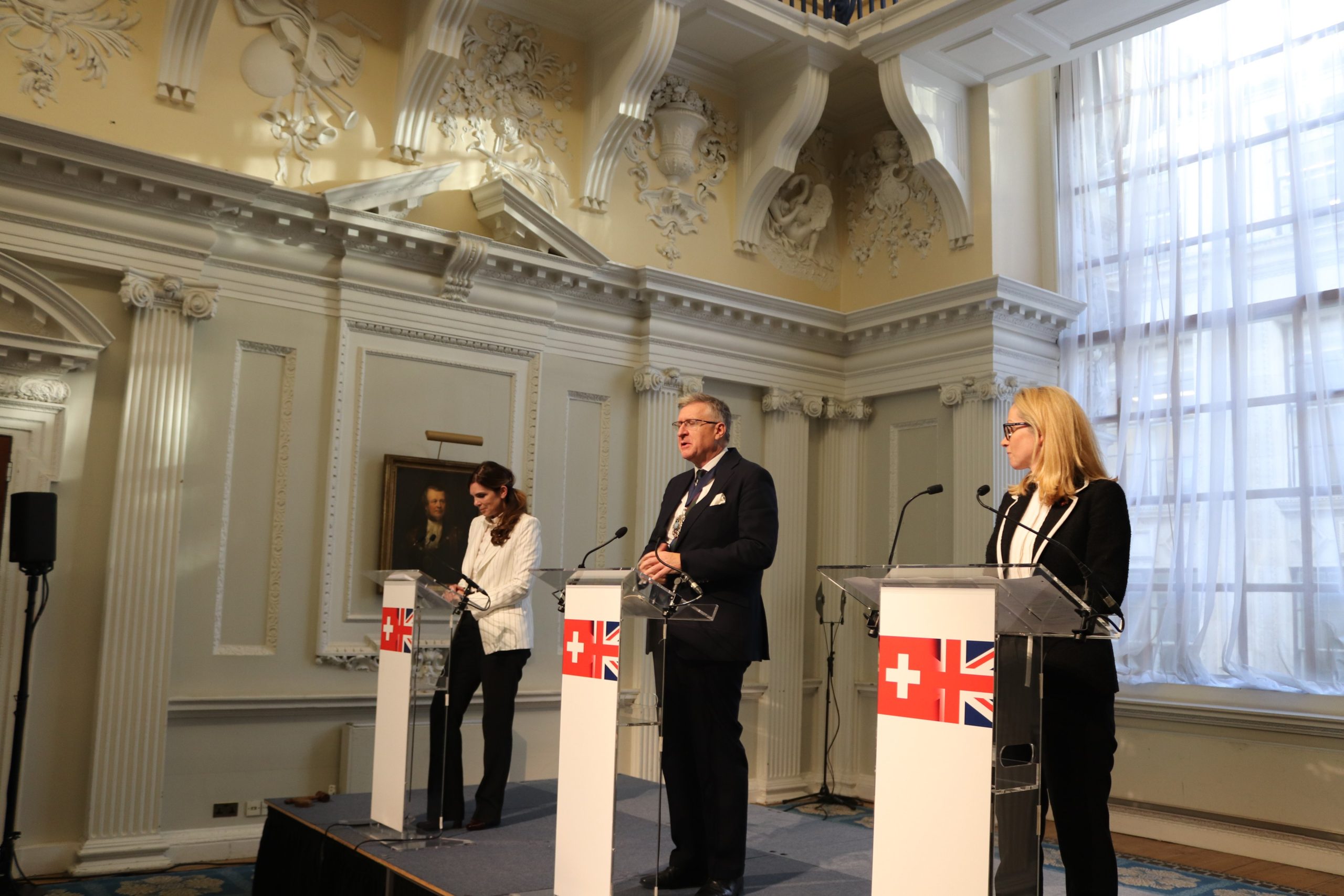

Photo credit: City of London Corporation